Baby boomers

With Ireland and France currently the only two countries in Europe to not experience a decline in birth rates, the baby category here continues to thrive. Quality is paramount for all parents when providing for their precious new bundle, and the successful manufacturers are those who have truly captured this trend in their brand messaging and have resonated with parents’ concern to do the best job possible for their little ones

23 March 2016

AT A GLANCE: BABY

- Euromonitor reports that the baby and child-specific market in Ireland was worth almost €41m in 2014*

- The baby food market is said to be almost recession-proof, as illustrated by the period 2011 – 2016 in which the category grew by an average of 6% while all other food markets grew by 2%

- Aptamil Profutura Follow On and Growing Up milk include the brand’s highest ever levels of DHA (Omega 3 LCP)** which support normal visual development

- Cow & Gate is introducing The Super Yummies – a new range of snacks, developed by mums and nutritionists for little ones aged 12 months+.

- Heavenly’s Crispy Veggie Waffles are available in two tasty flavours, Carrot and Cumin and Sweetbeet and Shallot. They not only contain over 50% vegetables in each one but also have no hidden nasties including no added sugar and are 100% free from additives or preservatives

- Kelkin Kids Organic Rice Cakes, available in two flavours, Apple and Blueberry, can be enjoyed by kids from just nine months of age. They are egg free, nut free and low in fat, with no artificial preservatives or colours and contain only 17 calories per rice cake

- The Pip and Pear baby food range has won gold, silver and bronze at the 2014 and 2015 Blas na hEireann National Food Awards and also picked up the 2015 ‘Best Baby Food’ award, beating off stiff competition from big name brands such as SuperValu and Aldi

- Baby food sales of €93 million are anticipated for 2020***

*(Source: Euromonitor’s Baby and Child-Specific Products in Ireland, May 2015)

**(Source: Aptamil Profutura Follow On milk contains 33% more DHA (Omega 3 LCP) than in all Aptamil Follow On milks)

**(Source: Aptamil Profutura Growing Up milk contains 35% more DHA (Omega 3 LCP) than in all Aptamil Growing Up milks)

***(Source: Baby Food in Ireland, Euromonitor International, August 2015)

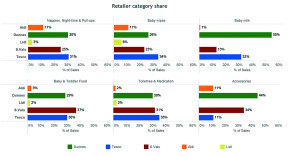

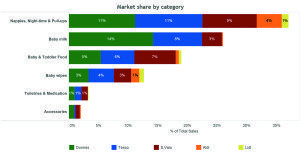

Nappy subcategory leads value sales, followed by baby milk and baby & toddler food: Reep

Reep, the data and insights business, looked at the high-level trends in the baby category over the six months concluding February 2016. Serving 2,905 customers, across a total of 17,480 shopping trips at the top five Irish retailers, Reep divided the category into six subcategories:

Reep, the data and insights business, looked at the high-level trends in the baby category over the six months concluding February 2016. Serving 2,905 customers, across a total of 17,480 shopping trips at the top five Irish retailers, Reep divided the category into six subcategories:

| Subcategory | Examples |

| Baby milk | Baby milk, powder and formula |

| Baby & toddler food | Baby rice, jars, pots, pouches, meals, rusks, smoothies and snacks |

| Wipes | Baby wipes, fragrance wipes, sensitive wipes and toddler wipes |

| Nappies, night-time and pullups | Disposable nappies, nappy sacks, pull-up pants, night-time pants and swimming pants |

| Toiletries & medication | Nappy cream, baby lotion, baby shampoo, baby powder and oils. subcategory also includes over-the-counter baby medication |

| Accessories | Sippers, bottles, soothers, mats and disinfectants |

The nappy subcategory was the most significant in terms of value, representing some 37% of category sales. Baby milk and baby & toddler food ranked second and third in terms of sales, collectively accounting for circa 45% of category sales over the six-month period.

The nappy subcategory was the most significant in terms of value, representing some 37% of category sales. Baby milk and baby & toddler food ranked second and third in terms of sales, collectively accounting for circa 45% of category sales over the six-month period.

While all five of the Irish retailers compete in the category, the three multiples dominate, accounting for more than 90% of total sales. Dunnes is particularly strong in the category, with circa 36% market share by sales overall. During the six-months under review, the baby milk subcategory made up about 39% of Dunnes baby category sales. These Dunnes sales in turn represent an astonishing 55% of the total baby milk sales across the five retailers.

Baby food

The baby food subcategory is more widely contested. While the supermarket multiples dominated, SuperValu was the leading retailer over the period with 37% of sales, with Tesco and Dunnes hotly contesting the second place with 30% and 29% of subcategory sales respectively.

The baby food subcategory is more widely contested. While the supermarket multiples dominated, SuperValu was the leading retailer over the period with 37% of sales, with Tesco and Dunnes hotly contesting the second place with 30% and 29% of subcategory sales respectively.

The discounters generally under-index in the baby milk and baby food subcategories, they are however well represented in the nappies and baby wipes subcategories. These two subcategories make up 85% of Aldi’s category sales, and 80% of category sales for Lidl.

Toiletries & medication and accessories

Toiletries & medication and accessories

In terms of total sales, it is noteworthy that the toiletries & medication and accessories subcategories comprised just 5% of category sales in the six months ending February 2016. Dunnes topped accessories sales with 44% of the subcategory, whereas Tesco topped toiletries and medication, with 35% of subcategory sales. A relatively strong performance by Aldi in the accessories subcategory was also noted.

Reep provides crowd sourced real-time consumer data, bringing you actionable insights.

Find out how Reep can help your business.

CONTACT PAUL OR JONATHAN

www.reeprewards.ie

The instinct among new parents is to give their child the best quality of everything they need – nappies, wipes, food and everything in between. As a result, value-for-money and quality combined are what those parents will be looking for. Euromonitor reports that the baby and child-specific market in Ireland was worth almost €41m in 2014*. In fact, the baby food market is said to be almost recession-proof, as illustrated by the period 2011 – 2016 in which the category grew by an average of 6% while all other food markets grew by 2%, in a time when economic pressure gripped the country.

Even when budgets are tight, nutritional benefits are of paramount importance to parents. According to Mintel food and drink analyst, Colette Warren: “Brands could offer parents more reassurance about the healthiness of manufactured baby/toddler food by referencing more actively on-pack all the nutritional qualities the product has to offer, acknowledging key nutrients such as protein, calcium and carbohydrates.”

In Mintel’s ‘Baby Food and Drink’ report published for the UK market in April 2015, manufactured baby food faces ongoing competition from homemade versions. However the report states referencing nutrients more actively on-pack will alleviate these concerns. “When possible, brands should state when the product is high in a particular nutrient,” it adds.

The report finds there is also scope for baby/toddler snacks to extend usage past 36 months as a quarter of parents think baby/toddler snacks are a good choice for older children. Positioning baby snacks as suitable for older children has the potential to give this segment a greater shopping basket share and will also help brands to overcome the short window of opportunity that manufactured baby foods typically face in terms of usage.

Amy O’ Donoghue of Bord Bia’s Paris office reports that the trend for strong nutrition and naturalness is benefitting organic baby foods. She points out that baby food in France has seen a decrease in value in recent years, according to Linéaires magazine. However, the organic baby food sector, which makes up just 5.4% in value (€45m) of the total turnover of baby food in France, witnessed growth of 7% in 2014. O’Donoghue attributes this strong performance to the manner in which organic players have seized opportunities thanks to their association with naturalness and the quality of their recipes.

The good news for Ireland, unlike most of the rest of Europe, is that our birth rate is not in decline. Kate Holmquist recently described the situation in The Irish Times, stating: “Motherhood is tough, and in Europe women are turning away from it. Ireland and France are the only countries not experiencing a decline in birth rates. In Germany, with its high standard of living and robust supports for families, such as childcare and generous parental leave, women are running away from motherhood.

“No one knows why Ireland has bucked the trend and continues to produce babies, even though the supports for parents in Ireland are among the worst in Europe,” Holmquist continued. “We’ve been through punishing austerity and yet we’re still having babies. We’re having more babies than in Sweden, which has five-star supports for parents, and Spain.”

While the reasons behind Ireland’s surprisingly strong birth rate remain something of a mystery, what we can say with complete certainty is that this is positive news for the baby category.

*(Source: Euromonitor’s Baby and Child-Specific Products in Ireland, May 2015)

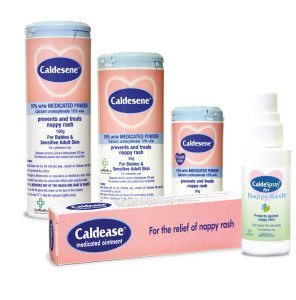

Effective nappy rash treatment

The Caldesene range now includes Caldesene Powder, Caldease Ointment and CaldeSpray

The Caldesene* range has seen great expansion over recent years and now consists of Caldesene Powder, Caldease Ointment and CaldeSpray.

Caldesene Powder is a medicated baby powder that prevents and treats nappy rash. It works by attacking harmful bacteria and soothing skin irritation. Its special formulation also means that it forms a barrier against wetness on a baby’s skin. Caldesene Powder is available in three handy sizes, 20g, 55g and 100g.

CaldeSpray is a zinc oxide milk spray for nappy rash. This concentrated spray has excellent skin adherent and skin protective properties which form a protective barrier against wetness. There are approximately 125 changes in each bottle of CaldeSpray. CaldeSpray is the ideal choice for busy mums and dads on-the-go for the following reasons:

- Easy application

CaldeSpray couldn’t be easier to use – Shake well and apply one to two sprays to baby at each nappy change to protect against nappy rash.

- No need to rub

Spray and go – With CaldeSpray there is no mess and no sticky fingers.

- No direct contact with skin. This eliminates the danger of infection and cross-contamination.

- No need to irritate baby’s delicate skin

There is no need to worry about further irritating the affected area or causing baby any pain or distress as the skin does not need to be touched.

Why does nappy rash occur?

When a baby wets a nappy, bacteria react with the urine on the nappy to form ammonia. If the nappy isn’t changed quickly, the ammonia can ‘burn’ the baby’s delicate skin. If a nappy is wet and soiled at the same time, this causes a different chemical reaction which can irritate and damage the skin even more.

*(CaldeSpray contains zinc oxide 10% w/w. Caldesene Medicated Powder contains calcium undecylenate 10% w/w. Always read the label.)

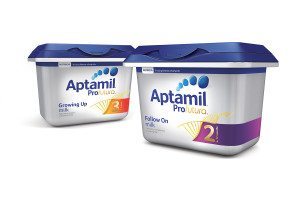

Most advanced formulas yet

Aptamil Profutura Follow On and Growing Up milks contain specific nutrients tailored to complement a baby’s diet

Inspired by the science of early life, Aptamil’s scientists have developed Aptamil Profutura Follow On and Growing Up milks, the brand’s most advanced formulas yet. They contain specific nutrients tailored to complement a baby’s diet in order to support them as they undergo significant growth and cognitive development. Aptamil Profutura Follow On and Growing Up milk contain Aptamil’s unique blend of ingredients including its highest ever levels of DHA (Omega 3 LCP)* which support normal visual development. They also contain sources of calcium and vitamin D which support normal growth and development of bone.

Aptamil Profutura Follow On and Growing Up milk is now available in the brand’s most innovative pack ever, the Smart Pack. The new 800g Smart Pack features a tamper-proof lid for added security, a built in leveller on both the left and right hand side, making scooping easier, an underlid scoop storage as well as a scoop rest for storing the scoop between use for improved hygiene.

*(Source: Aptamil Profutura Follow On milk contains 33% more DHA (Omega 3 LCP) than in all Aptamil Follow On milks)

*(Source: Aptamil Profutura Growing Up milk contains 35% more DHA (Omega 3 LCP) than in all Aptamil Growing Up milks)

(IMPORTANT NOTICE Breastfeeding is best for babies. Aptamil Profutura Follow On milk is only for babies aged six months and over as part of a varied weaning diet and should not be used as a breastmilk substitute before six months. All formula milks should be used on the advice of your healthcare professional. Aptamil Profutura Growing Up milk should be used as part of a healthy, balanced diet.)

Scrumptious for little tummies

Aptamil Profutura Follow On and Growing Up milks contain specific nutrients tailored to complement a baby’s diet

Cow & Gate is introducing the Super Yummies – a new range of deliciously different snacks, developed by mums and nutritionists for little ones aged 12 months+. Super Yummies are made from carefully selected ingredients to create new, unique and exciting tastes and textures for toddlers to discover.

Part of the well-loved Cow & Gate family, the brand states the Super Yummies are superbly tasty and come in scrumptious flavours for little ones’ tummies. With only naturally occurring salt and sugar, this makes the range appealing for both mum and their little one.

Perfect to fuel little ones’ everyday adventures, the range includes breadsticks, rice cakes, and a variety of fruit and yoghurt pouches – all of which taste, look and feel like the real deal

The Super Yummies promise includes that the range delivers tailored nutrition for toddlers; that they’re developed with mum and nutritionists; and that they contain only naturally-occurring salt or sugars.

Going waffles over veggies!

Heavenly’s Crispy Veggie Waffles are available in two tasty flavours, Carrot and Cumin and Sweetbeet and Shallot

With Heavenly’s innovative snacking range already proving highly popular, the company has just gone and done it again…this time with the organic and super healthy Crispy Veggie Waffles. The latest creation, in Heavenly’s ever-growing list of organic healthy snacks, the new Crispy Veggie Waffles are jam packed with organic goodness and contain over 50% of vegetables in each and every yummy little waffle.

Crispy Veggie Waffles are designed, not only with health in mind, but also convenience for parents and are suitable for children from 12 months onwards. Available in a 30g box, these exciting new snacks are ideal for on-the-go snacking and also lunchboxes.

Available in two tasty flavours, Carrot and Cumin and Sweetbeet and Shallot, these delicious little waffles not only contain over 50% vegetables in each and everyone but also have no hidden nasties including no added sugar and are 100% free from additives or preservatives.

Available in a 30g box, Heavenly’s Crispy Veggie Waffles are ideal for on-the- go snacking and also lunchboxes

Heavenly is the brainchild of Shauna McCarney-Blair, a mum to three children, and a lover of all things organic and nutritious. She first came up with the idea for Heavenly when she was frustrated by the limited choice of baby food products in Northern Ireland for children, and then when her children were diagnosed with allergies and the choice was limited even further, she knew she had to do something about it.

McCarney-Blair began by creating a guilt-free range of organic baby weaning meals for the Northern Ireland and Republic of Ireland market, and now Heavenly has moved into snacks, with availability across mainland UK and Ireland.

Heavenly’s Crispy Veggie Waffles will be available from Ocado in the UK via Heavenly online at www.shop.heavenlytasty.com and SuperValu stores across Ireland.

Only 17 calories per rice cake

Kelkin Kids Organic Rice Cakes contain no artificial preservatives or colours, and only 17 calories per rice cake

Kelkin Kids Organic Rice Cakes come in two flavours, Apple and Blueberry

Kelkin Kids Organic Rice Cakes come in two flavours – Apple and Blueberry, and can be enjoyed by kids from just nine months of age. With no artificial preservatives or colours, and at only 17 calories per rice cake, parents can be sure they are giving their kids the best snacks either at home or when they’re out and about. Kelkin Kids Organic Rice Cakes are also egg free, nut free and low in fat, making them the ideal choice for parents catering for kids with allergy concerns. They are currently stocked in Tesco and SuperValu stores nationwide.

Nutritious and convenient

The Pip and Pear chilled baby food range launched in May 2015 and is quickly becoming the go to baby food for time-pressed parents looking for a nutritious and convenient alternative to their own home-cooking. The Irish-made range of chilled baby meals are gently cooked using 100% Irish Bord Bia approved meat and poultry and certified organic fruit and vegetables. Each pot of Pip and Pear contains up to two of a tot’s five a day and also contains no added salt, sugar or additives. All of these USPs reinforce their tagline ‘all of the goodness, none of the guilt’.

The Pip and Pear chilled baby food range launched in May 2015 and is quickly becoming the go to baby food for time-pressed parents looking for a nutritious and convenient alternative to their own home-cooking. The Irish-made range of chilled baby meals are gently cooked using 100% Irish Bord Bia approved meat and poultry and certified organic fruit and vegetables. Each pot of Pip and Pear contains up to two of a tot’s five a day and also contains no added salt, sugar or additives. All of these USPs reinforce their tagline ‘all of the goodness, none of the guilt’.

Set up by Irene Queally, mother of two and restaurateur, Queally saw a demand for a baby food range that was just like home cooking; nutritious, tasty with vibrant flavours and textures. Sustainability is also significant to Queally and so Pip & Pear is now a verified member of Origin Green.

Irene Queally, mother of two and restaurateur, launched the Pip and Pear Chilled Baby Food range in May 2015

Merchandised in the dairy fridge, Pip and Pear caters for babies from five months to 15 months and holds a shelf life of 28 days. The range has won gold, silver and bronze at the 2014 and 2015 Blas na hEireann National Food Awards and also picked up the 2015 ‘Best Baby Food’ award, beating off stiff competition from big name brands such as SuperValu and Aldi.

A recent report into the baby food sector has identified sales of €93 million anticipated for 2020 along with the emerging trend of brands seeking to provide products “which could emulate home-cooking for parents” the report also acknowledges that the Pip and Pear range has “a shorter shelf life with 100% “real food” and the convenience that many busy parents demand, but also nutritionally healthy for babies.” (Source: Baby Food in Ireland, Euromonitor International, August 2015)

Pip and Pear is available in over 100 SuperValus nationwide and has begun exporting to Carrefour Hypermarkets in Spain. 2016 will see major growth for this new Irish start up with a keen eye and strategy for further development in the Irish and export market.

Print

Print

Fans 0

Followers