Back to school budgets hit by 11.9% increase in price of lunchbox staples: Kantar

Kantar reports price of back-to-school essentials (bread, ham, cheese, yoghurt, cereal and milk) rose by 19.5%, making a basket of these staples €2 more expensive

20 September 2022

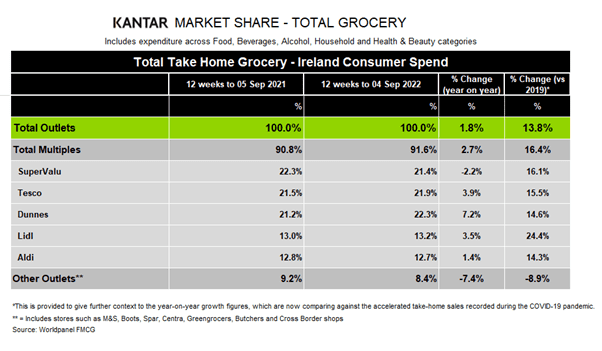

Take home grocery sales in Ireland increased by 1.8% in the 12 weeks to 4 September, thanks mostly to a 7.8% increase in average prices, as grocery price inflation hit 11%, Kantar reports.

Essentials see biggest jumps

In the four weeks to 4 September, the price of back-to-school essentials (bread, ham, cheese, yoghurt, cereal and milk) rose by 19.5%, making a basket of these staples €2 more expensive.

The most basic items saw some of the biggest jumps with bread up 20%, ham up 12%, milk up 26%, yoghurt up 17%. Collectively, shoppers spent an additional €17m on these products compared to the same period last year, driven entirely by price as volumes were down 6%.

‘Additional €768 a year’

“Grocery price inflation is at its highest level since Kantar began tracking grocery price inflation in May 2008,” said Emer Healy, Kantar senior analyst. “As food and drink prices continue to climb alongside increasing pressure on other household bills, the impact is unavoidable for many Irish consumers. The average annual grocery bill could go from €6,985 to €7,753 – that’s an additional €768 a year that Irish consumers will have to spend if they do not make any changes to what they currently buy or where they shop.”

Impact on own-label and online

As consumers search for better value, the biggest winners are retailer own-label lines. In the latest 12 weeks, sales of own-label products are up 5.8%, representing an additional €72m year-on-year. Value own-label ranges, the very cheapest products in the range, saw even stronger growth up 21.4% compared to the same period last year as shoppers spent an additional €10.2m.

The cost-of-living crunch has also encouraged an influx of new shoppers to go online. In the last four weeks alone, volumes were up as shoppers increased their packs per trip by 2.9% contributing an additional €6.8m to the overall market performance. More than one-in-10 Irish shoppers (12%) now purchase their groceries online.

Sales value rises at grocery giants

Appealing to the need for better deals has helped all major retailers to grow in the last 12 weeks. Market leader Dunnes (22.3% value share) saw growth of 7.2% year-on-year, helped by an influx of new shoppers (up 4.7%), and an increase in shopping trips (up 1.7%). Dunnes traditionally performs well at back-to-school times and experienced strong own-label growth of 13% year-on-year.

Tesco sits at 21.9% share, with sales up 3.9% compared to last year as shoppers return to store more often (6.6%), while SuperValu (21.4% share) continues to attract more trips than any other retailer, with an average of 21.5 trips made in the last 12 weeks. Lidl holds 13.2% share growing 3.5% year-on-year, while rival low-cost retailer Aldi sits at 12.7% share an increase of 1.4% as a result of existing shoppers retuning to store more often.

Print

Print

Fans 0

Followers