ShelfLife Insights: Natural Response

A new survey of retailers, carried out by ShelfLife on behalf of Bord Gáis, has yielded some fascinating and quite telling results regarding energy usage, awareness and many other aspects of the industry. In this special feature, Doug Whelan takes a deep-dive into the data to find out more about attitudes and intentions...

29 June 2017

Earlier this year, Bord Gáis and ShelfLife commenced a project together surveying retailers across the country, with a view to gauging the various levels of energy awareness among the sector. Now more than ever, energy costs are considered a major part of any business. For retailers, who expend high levels of energy through their equipment and facilities, keeping costs down is a going concern.

This awareness was the broad topic of the survey carried out by ShelfLife, which was answered by 182 retailers from across the country. The retailers were queried as to what their source of energy is as well as their commercial provider, before being asked a range of questions which yielded specific results on their energy consumption and spending, such as what areas of the store are currently generating high or low energy bills, and whether or not retailers are aware of how they can work to reduce that spending.

Ken O’Byrne, SME category manager at Bord Gáis Energy, explains the provider’s objective in commissioning this comprehensive survey. “At Bord Gáis Energy, we supply electricity and gas to almost 45,000 businesses customers in Ireland,” he says. “We carried out this survey with ShelfLife in order to shine a light on energy use and attitudes to energy in the Irish retail sector.

“We understand that running a retail business involves putting in 110% in terms of effort and focus,” O’Byrne says, “and that sometimes there isn’t much time available to consider how switching energy provider, negotiating a better deal with your current provider or simply carrying out some energy efficiency activity can make a real difference to your bottom line.”

Indeed, the survey yielded very strong results which demonstrate that there is real interest in this area. There is strong potential overall for retailers to discover the potential savings available and keep their costs down, while also contributing to the environment by reducing their overall usage.

To read and explore these results, read on…

Staff numbers and business locations

8 The survey opened with simple questions about store and business sizes, staff numbers and location. Out of the respondents, 14% said they employ less than five staff, while 30% employed between five and 20 staff. 25% of those surveyed said they employ between 20 and 50 staff, while 32% had more than 50 people on their books.

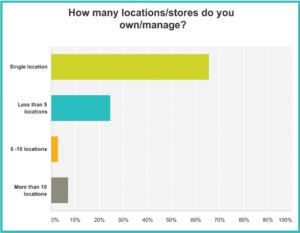

Next, the respondent retailers were queried on the number of locations or stores that make up their business. Two-thirds of respondents (66%) were businesses with one location only, while almost a quarter (24%) were located in between one and five locations. A small number (3%) ran between six and 10 locations, while 7% were present at ten locations or more.

With regard to the location of the survey respondents, the results were wide-ranging. 173 individuals answered by choosing the locations of their business or businesses; due to one-third of all respondents operating their business on more than one store location, the results showed that 49 operated in Dublin city and 48 operated in the greater Leinster area. 51 respondents had businesses in Munster, 33 respondents had stores in Connaught and 17 respondents ran businesses in Ulster.

Regular cost analysis can guide the way

Users of natural gas are less likely to step back to analyse the cost of their business

Having established the location and size profile of the respondent retailers, the survey went on to ask respondents a key question: whether or not they are users of natural gas. The response to this question set off a branching set of answers, in which the same questions were separately put to retailers who do use natural gas, and retailers who do not.

Of the 182 respondents, 36% said that they use natural gas, while 64% revealed that they do not. Ken O’Byrne states that while Gas Networks Ireland are expanding the network, only around 10% of business customers currently use natural gas. It is likely that dual fuel is used by a higher number of respondents than there in the market generally. Nonetheless, the answers provided by these natural gas users offered some useful insight.

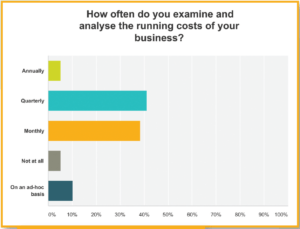

Retailers have many concerns when it comes to the running of their business, and were asked in the survey how often they examine their costs. Of the group who did indeed use natural gas, the largest answer was 41%. These retailers revealed that they survey their own costs on a quarterly basis. 38% of natural gas users said that they do so on a monthly basis, 10% said they do so on an ad-hoc basis, which is to say semi-regularly.

Retailers have many concerns when it comes to the running of their business, and were asked in the survey how often they examine their costs. Of the group who did indeed use natural gas, the largest answer was 41%. These retailers revealed that they survey their own costs on a quarterly basis. 38% of natural gas users said that they do so on a monthly basis, 10% said they do so on an ad-hoc basis, which is to say semi-regularly.

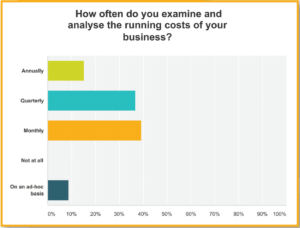

When the same question was put to those retailers who are not users of natural gas, the results were marginally different. Of the respondents, zero said that they never review and analyse their running costs, while 9% said they do so on an ad-hoc basis. 15% said they carry out the audit on an annual basis, 36% do so on a quarterly basis and 40% do so on a monthly basis.

The cost of doing business: Energy

Energy Costs in both camps were, by a vast amount, the highest outgoing for retailers who responded

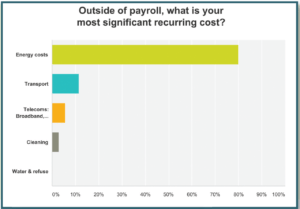

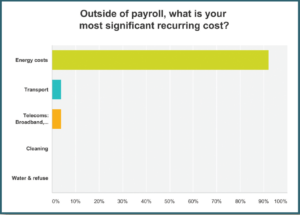

Next, respondents were asked a more specific question about their energy costs. The areas were broken down into the following options: Energy costs, transport, telecommunications, cleaning, and water/refuse.

The answers to this question, regardless of whether they were in the natural gas or non-natural gas-using camp, were very revealing as to what most retailers consider to be their most significant recurring cost.

The vast majority of retailers responded that energy is their most significant cost (not counting payroll). 80% of natural gas users confirmed this, alongside 92% of non-natural-gas users.

The other responses paled in significance: the first grouping cited Transport with 11% significance, the second said 4%. Telecommunications made for 6% of natural gas users, and only 4% for non-users. 3% of natural gas users said cleaning is a significant cost, alongside zero percent of non-users. Similarly, both camps assigned zero percent significance to water & refuse.

Energy Costs in both camps were, by a vast amount, the highest outgoing for retailers who do not use natural gas

The significance of this response is clear. Almost all retailers, regardless of the size of their store, their location or any other physical factor, consider their energy costs to be the most significant part of the business, after the wage bill. Even without knowing that answer, the next logical question in the survey was of course to query retailers on the specifics of their energy costs; the answer to this question also yielded some fascinating data, and a significant insight into the difference between users of natural gas and users of other sources of energy.

The question was ‘what is the biggest energy cost currently facing your business?’ and the available answers were lighting, heating, refrigeration, ventilation & air or other.

By some distance, the biggest energy cost for both groups was refrigeration, which numbered 58% and 59% for the two camps. However, the insight comes from the next levels down. Among non-users of natural gas, 28% said that lighting was their biggest cost, while just 8% said the same about heating. However, in the first group, the cost of lighting was deemed to be vastly lower – just 14% of natural gas users cited it as their biggest cost, while heating was significantly higher, with 22% calling it their biggest cost.

Where the savings are

The next question in the survey was reserved only for those retailers who were users of natural gas. Those retailers were asked if they were aware of the opportunity to use gas to save cost on the same outgoings. A massive 83% answered in the affirmative regarding heating, while 23% were aware of the savings available on refrigeration, 20% on lighting and 17% on ventilation & air.

Up to this point, the survey was concerned only with whether or not respondents were natural gas users or not. At this point, it was detailed as to which specific energy provider each was using. Once again, these responses offered valuable insight when combined with the previous responses regarding specific energy costs and outgoings.

For both camps, Electric Ireland was the most popular provider, with 42% and 65% between users and non-users. Bord Gáis was the next most popular among natural gas users with 37% penetration, while it was (not unexpectedly) quite low among non-users, with just 8% of retailers in that camp being Bord Gáis customers.

Engagement in both camps with Energia was 13% and 10%, SSE Airtricity engagement was quite close, 16% and 15% respectively.

Finally, Flogas users made up 11% of the users’ camp, and precisely zero percent of the non-users’ camp.

Energy supplier satisfaction

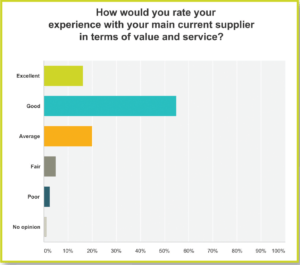

A majoritiy of non-users of natural gas were generally satisfied with their level of service

While there were few surprises in the previous section, the respondents for the next question yielded impressive results which matched very closely, when asked about their satisfaction levels for their energy providers. Exactly 56% of both camps answered ‘good’ when asked about their energy supplier’s value and service. 13% of natural gas users said they felt their energy supplier was ‘excellent’, while 16% of non-users said the same thing.

18% of natural gas users feel their energy supplier’s service is Average, as do 20% of non-users. No natural gas users said their service was Fair, while just 5% of non-users felt this way about it. 3% of users and 2% of non-users were of the belief that their service was poor.

Changing supplier: When is the right time?

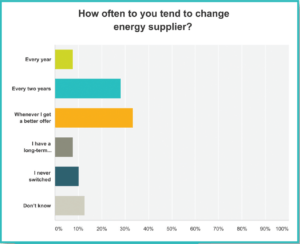

A majority of natural gas users said they would change energy supplier if they got a better offer

Returning to more practical areas of running a business and keeping an eye on one’s costs, the survey next queries reta ilers on when their energy supply contract is due for renewal – specifically, if they are aware of when that is, yes or no. In the natural gas users’ camp, 46% stated yes, while 21% stated no, and exactly one-third were unsure.

Meanwhile, 62% of non-users said yes, they are aware of when their contract is due for renewal; 16% said no and 22% said that they are not sure. What we can glean from these two prior responses is that while a large portion of retailers are unsure of when their energy contracts are up, an even bigger majority are satisfied on some level with their service and so are unlikely to be seeking to jump ship upon its expiry.

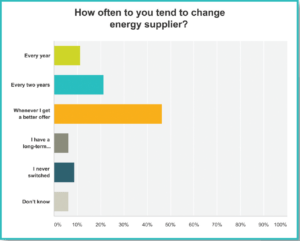

A higher percentage of non-natural gas users would be willing to change energy provider if the price was right

However, the next question on the survey queried retailers what their opinion was on just that: how often they tend to change energy providers. A majority in both camps (33% and 47% respectively answered “whenever I get a better offer” – slightly non-committal on their part, but also showing potential for providers to attract new customers away from their competitor.

28% and 21% of respondents said that they tend to change every two years, 8% and 11% said they do so every year. A small number on both sides (8% and 6%) revealed they have a long-term business relationship with their supplier, indicating they tend not to change providers at all, while 10% and 9% said they have never switched – indicating they have always been satisfied with their provider, but also that there may be potential to change if they were aware of the savings that may be available.

Regarding this openness to switching providers, Ken O’Byrne states that it’s vital for retailers to regularly check the status of their bills and contracts. “The majority of energy contracts are for 12 month periods,” he says, “and if business owners are not regularly checking their bills they may not be aware their contract is due for renewal.

“Out-of-contract rates can be up to 25% higher than contract rates,” he says. “You should choose a supplier who undertakes to advise you when your contract due for renewal.

“Not agreeing a renewal rate or switching providers on time can leave you out of pocket,” O’Byrne says.

The benefit of energy auditing

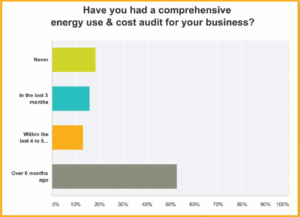

Users of natural gas tend to leave a longer gap between their energy usage audits

Approchaing the end of the survey, the retailers were asked a simple question that tied in with the prior query about how often they change their energy provider: Have you had a comprehensive energy use and cost audit for your business?

In the grouping which were users of natural gas, a 53% majority said they had done so within the last six months, while 38% of non-users said the same thing. 15% and 16% respectively said that they had taken the survey within the last three months, while 13% and 10% revealed they had done so over the last six months.

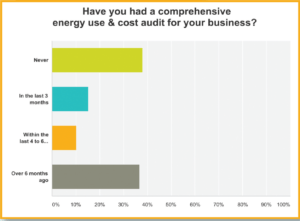

The biggest insight in the responses to this question was in the number of retailers who had never taken an energy use and cost survey. Just 18% of natural gas users said they had never had the audit, while more than twice that amount – 38% – said the same thing.

A high number of non-natural gas users have never carried out an energy usage and cost audit

Between retailers who are willing to change energy providers if they receive a better offer, and retailers who have never carried out an energy cost and usage audit for their business, there is strong potential for providers to attract new business customers, if they can be convinced that their energy usage and costs can be reduced.

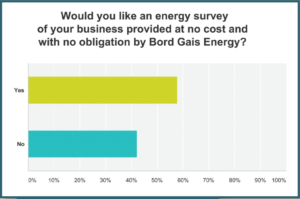

This is also then thrust of the final question in the survey, in which retailers were queried as to whether they would be willing to accept an energy survey of their business, free-of-charge and with no further obligation, carried out by Bord Gáis Energy. In the segment of existing natural gas users, 58% answered yes, while 42% answered no.

Meanwhile, in the non-users segment, 57% said they were unwilling to take the energy survey for their store, while just 43% said that they would.

This is further evidence that the potential for savings through energy audits and careful selection of providers can be amplified by dissemination of appropriate information.

Potential to further lower costs

Natural gas users tend to have more awareness that they can further reduce their energy costs

In closing, the retailers were asked a multiple-choice question which offered a series of responses, namely, what are the top three concerns when choosing an energy supplier? Popular responses were lowest overall cost (rated number one by 92% by natural gas users and by 74% of non-users), and the availability of a long-term contract, which was rated number two by 57% of natural gas users and number three by 69% of non-users. Account management services and energy efficiency advice also rated highly in both segments.

In the current climate, where energy efficiency is considered a strong consideration for businesses, many retailers are attempting to reduce their carbon footprint. Energy providers, meanwhile, are keen to get across that they are reducing their own emissions while also reducing costs. In closing, the response to this survey reflects this sentiment, and the potential for many retailers to reduce their emissions and their outgoings at the same time.

In closing, Ken O’Byrne urges all retailers to keep a close eye on their individual energy costs, outgoings and contract rates. “This survey shows that there is real interest in this area,” he says.

“We at Bord Gáis want to help retail businesses across the country, whether they are with us or not, to save money and increase their energy efficiency.”

To learn more, visit www.bgebusinesshub.ie or call Bord Gáis Energy’s business energy experts on 1850 405 805.

ShelfLife Insights are presented online on ShelfLife.ie and published in print in ShelfLife Magazine. With your own tailored survey, aimed at our readership, you can capture valuable market research to define successful sales, marketing and PR strategies. For more information contact Mark Morgan on 01 294 7767.

Print

Print

Fans 0

Followers